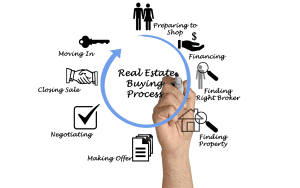

The decision to move out of a large residence in favour of a smaller or less expensive property, also known as down-scaling, is often viewed as a last resort in the face of mounting financial pressure. However, for many retirees, the decision to downscale is driven by the prospect of greater freedom.

As one gets older, the responsibilities of maintaining a large freehold home and undertaking activities such as garden and pool maintenance, cleaning, and repairs, can become overwhelming. Still, many older individuals feel a natural emotional connection to their homes. After all, they’ve seen their children grow up in it, and they’re unwilling to lose these memories entirely. Thus, some retirees with cash to spare are opting for a ‘best of both worlds’ approach. This involves purchasing a smaller primary residence in a life rights estate or sectional title complex and converting their former home to a secondary residence or holiday home.

The coast beckons

As to the kind of retirement properties this demographic is purchasing, Light-stone data shows that the Western Cape is the only major region where properties in estates (55%) are more popular among retirees than freehold and sectional title homes. It’s no secret as to why estates are so popular among discerning retirees—they offer safety, lifestyle, and a built-in community of like-minded individuals to ensure that new residents feel comfort-table and supported in their new life stage. Downscaling with the intention of making budget available for a holiday home is also proving to be a popular trend among South Africa’s retirees—and the majority of them are heading to the coast. This is especially prevalent among those who own an inland property and are in search of more leisure activities. Data from ooba Home Loans shows that for all bonds granted between June 2021 and June 2022, 0.41%, 0.18%, and 1.04% were for holiday properties in the Western Cape, Kwa-Zulu Natal, and the Eastern Cape respectively.

A home close to home

Generally, retirees are purchasing holiday homes that are easily accessible. Those wishing to go down this path are encouraged to choose a holiday home within comfortable driving distance from their new retirement unit, to ensure that they are able to enjoy it regularly. In the Western Cape, for example, popular holiday destinations such as Langebaan, Hermanus, and Betty’s Bay are all less than two hours outside of Cape Town. Lightstone data shows that 57% of individuals who own two properties prefer to own these in the same province.

Pros and cons of investing in a holiday home

Of course, holiday home ownership as a retiree has its pros and cons, and there are a number of important considerations to keep in mind before embarking on this journey.

Pros:

Keeping a special family home intact: For those who are converting their prior primary residence into a holiday home, this decision allows retirees to return to the place that holds happy memories, and create new ones.

Less day-to-day maintenance: Making a large home your secondary residence means that there will be less daily wear and tear on the home that will need to be addressed, especially if the house is occupied only a few times a year.

Additional income: Should you wish to rent out your holiday home, this is a great way to earn passive income as a retiree. It’s important to remember that renting out your home comes with various day-to-day responsibilities such as regular cleaning and guest check-ins. It is therefore recommended that you hire reliable staff to manage these tasks, as they can become burdensome.

A value-building investment: A well-located and maintained holiday home will only appreciate in value as the years go on, giving you a lucrative asset to leave behind for your loved ones.

Cons:

Additional security concerns: Crime is a reality in South Africa, and if a property is vacant for a large period of time, criminals may take note. Be sure to invest in a good security system and regular monitoring from a local private security company.

Additional expenses: If the bond on your former family home is not paid off, or if you have purchased and financed a new holiday home, you will have to factor in monthly repayments that will be subject to interest rate increases.

Additional responsibilities: Depending on the size, location, and whether or not you are renting it out, taking on the responsibility of a holiday home may reduce some of the ‘lock-up-and-go’ lifestyles sought out by retirees.

Conclusion

Retirees who are considering investing in a holiday home are urged to take into account the additional responsibilities that this will entail—and, if possible, to find help in sharing the load. Be sure to speak to family members. If they wish to enjoy the benefits of a holiday home, perhaps they are also willing to help manage it. Your ‘Golden Years’ are meant to be a time of relaxation and pleasure—and your seaside cottage should facilitate beach walks and sunrise meditations, not additional stress and financial pressure.

Written by Gus van der Spek

Gus van der Spek is the owner of Cape Town-based retirement development Wytham Estate.

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)