The property market for 2020 initially proved to be a buyers’ market. Though with the rise of the COVID-19 pandemic and the resultant lockdown’s effects on the economy, the question is whether it still is.

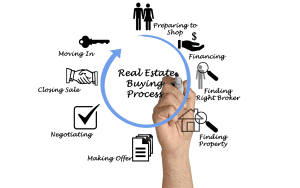

The transfer duty threshold was lifted by R100 000, loan approvals were higher than they had been in years and interest rates were lowered. This was all before the pandemic took hold of our country. At the time of this writing, the cut in rates have resulted in the repo rate and interest rate both being lower than they’ve been in decades. These reduced rates are creating more and more opportunities for buyers to enter the market, as borrowing costs are aimed at improving affordability. Where buyers may think that a savings of R648 in monthly repayments on a R1-million bond is something inadmissible, at the end of a 20-year repayment period, the savings will amount to more than R150 000.

Another benefit is that banks are lowering the requirements for home loans drastically to assist more citizens in entering the market. The minimum monthly income for a R1-million loan to be considered, which used to be R33 000, has been lowered by R5 000. This means that individuals from a lower income bracket will now be able to enter a wider market.

However, these were measures were implemented before the pandemic and were meant to battle the economic recession that already had South Africa on the brink of junk status. The fact is that new measures may be needed to truly battle the effect of the pandemic. Relying on measures that were instated to counteract the recession’s impact on the property market may not be sufficient. It is vital that new measures that are created specifically to counteract the effect of the Covid-19 pandemic’s impact be created.

Until then, the market still favours buyers who remain largely unaffected by the lockdown. Taking advantage of the measures that were instated prior to the COVID-19 pandemic will effectively also help stabilise the market for the time being. But in an economic landscape that is still changing and adjusting, looking vastly different from what analysts predicted a year ago, even when market activity does increase, the overall growth of the property market may still prove to be negative due to lowered prices and lack of demand.

The most important thing now is for buyers and sellers alike to keep their heads about them and make smart investment decisions that will ultimately help strengthen the economy.

This article is a general information sheet and should not be used or relied upon as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your adviser for specific and detailed advice. Errors and omissions excepted (E&OE)