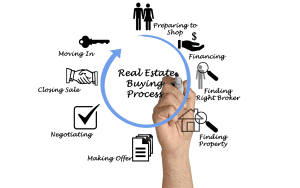

Despite the recent interest rate increase, South Africa is still currently in what is deemed a “buyer’s market”, where first-time homebuyers are enjoying the opportunity of entering the property market at a much earlier stage than their financial situations would have allowed in previous years.

But it’s precisely the fact that so many homebuyers are entering high-stakes financial decision-making for the first time that requires a crash course in basic questions that will help you make the most of the opportunity. Because just like falling in love, buying your first property can easily leave you seeing the world through rose-coloured glasses.

So, before you take things to the next level with your dream home, take a second (or few good hard moments, hours, days – however long it takes you) to ask yourself the following questions.

- Is it young love or have you found the real thing?

Aaaah, falling in love. We all remember those first few weeks of utter hormonal bliss and being absolutely mesmerised by our high school crushes, don’t we? Well, it’s the same with a property. Falling in love is easy. That first tour through the property often makes everything look perfect, as if you stepped into the home you’ve been daydreaming of.

But just wait till the second tour. That’s where you pick up on the irritating character traits and shortcomings you somehow missed while in your infatuated state. This is where you find out if it’s true love. So, take that second tour of the property, and see if it wouldn’t be better for you to continue seeing other people.

- Are you (and your income) ready to take things to the next level?

Going on a few dates, buying flowers and gifts here and there – dating usually isn’t a great financial burden. Once another person becomes a constant factor in your budget, however, the effect isn’t quite as inconsequential. So, get out your calculator and start number crunching.

Owning a property comes with more costs than bond repayments. Agent fees, legal fees, transfer fees, monthly rates and taxes, general upkeep and maintenance — these are just a few of the major costs you need to keep in mind, on top of your monthly bond repayment, when finding room in your budget for homeownership.

This step may very well require you to call in the cavalry and get professional advice on the additional costs and whether your current financial situation can accommodate them.

- What are you looking for in the perfect home?

Being on the dating market is the most terrible place to be, especially when you’re wondering whether every person you meet is “the one”. When your only criteria in the property market is simply for the home to be on the market, finding the perfect match is going to be a nightmare. The only way to find your one true home, is to look for the specific characteristics.

It’s important to go beyond “two bedrooms with a yard”. Do the rooms get sunlight for your painting hobby? Is there enough space for that second bookshelf or your yoga corner? Is there enough shade for summer picnics? Will your vegetable garden get enough sunlight and shade? It’s important to remember that buying a home is a long-term relationship, and the property has to accommodate your life.

- Why have you, my dear abandoned home, been on the market so, so long?

There is nothing wrong with finding love later in life. However, when talking about a for-sale property, the question has to be asked: Why is no one interested? It’s not like it has been focusing on its career. Luckily, with a property that has been on the market for an extended period of time, you don’t have to rely on Facebook stalking to find the untold story.

With the assistance of home inspection services, buyers can truly get to know the prospective property, inside and out, before the Offer to Purchase is drafted. This will allow you to decern whether the property has been on the market due to flaws and damages or whether the home has been waiting just for you.

Where the seller is aware of any flaws, a disclosure form is attached to the Offer to Purchase, indicating the flaws and how they affect the value of the property. But even when a property is not sold voetstoots (as is, with all its defects detailed in the Offer to Purchase), it can still be difficult to be recompensed for damage claims once the sale is finalised and you’ve settled into your new home. So, do your due diligence and go over any prospective properties with a fine comb.

- Going steady or still seeing other people?

As with any relationship, you need to know if things are serious. When you’re head over heels about a property, it’s a good idea to find out if others have made offers before you. This will indicate to you how quickly you need to make your own offer. If you’re facing off with other interested buyers, you simply cannot delay in getting your Casanova going and making your own offer. However, if the property has been waiting just for you, you may have more room to negotiate the terms of sale.

Now we aren’t relationship experts, but we are property experts. And we look forward to hearing from you and helping you take things to the next level in your real estate journey.

This article is a general information sheet and should not be used or relied on as legal or other professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your legal adviser for specific and detailed advice. Errors and omissions excepted (E&OE)